I. Introduction to Retirement Cash Flow Software

Retirement cash flow software is a digital tool designed to help individuals plan for their retirement. It provides a comprehensive analysis of your financial situation, taking into account your income, expenses, investments, and other financial factors. This software is designed to provide a clear picture of your financial future, helping you make informed decisions about your retirement.

Planning for retirement is a critical aspect of financial management. It ensures that you have sufficient funds to maintain your lifestyle and meet your needs in your golden years. With the increasing life expectancy and rising cost of living, it is more important than ever to plan for retirement. Early retirement planning can help you achieve financial independence and enjoy a comfortable retirement.

Retirement cash flow software is a valuable tool in this planning process. It provides a detailed projection of your retirement income and expenses, helping you understand how your financial situation will change over time. This information can be used to make strategic decisions about your retirement, such as when to retire, how much to save, and where to invest.

II. Understanding the Functionality of Retirement Cash Flow Software

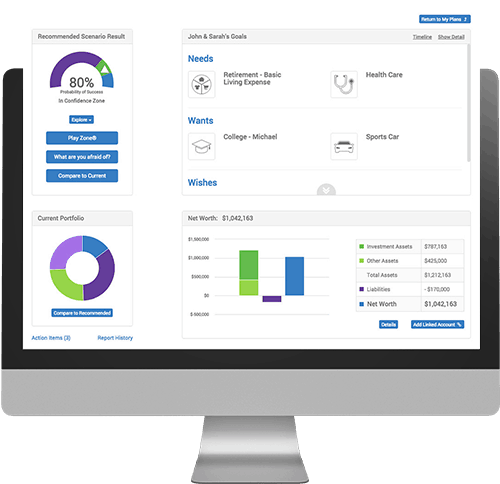

Retirement cash flow software works by gathering data about your financial situation and using it to project your future cash flow. This includes information about your income, expenses, savings, investments, and other financial factors. The software uses this data to create a detailed financial model, which can be used to project your cash flow during retirement.

The key features of retirement cash flow software include income projection, expense projection, investment analysis, and retirement scenario planning. These tools allow you to explore different retirement scenarios and understand how changes in your financial situation can impact your retirement. For example, you can use the software to understand how changes in your investment options can impact your retirement income.

Retirement cash flow software also provides a range of tools to help you manage your retirement finances. This includes budgeting tools, investment tracking, and tax planning features. These tools can help you stay on track with your retirement goals and ensure that you are making the most of your retirement savings.

III. Benefits of Using Retirement Cash Flow Software

Using retirement cash flow software can provide several benefits. First, it can improve the efficiency of your retirement planning. The software automates the process of financial analysis, saving you time and effort. This allows you to focus on making strategic decisions about your retirement, rather than getting bogged down in the details of financial analysis.

Second, retirement cash flow software can improve the accuracy of your financial projections. The software uses sophisticated algorithms to project your future cash flow, taking into account a wide range of factors. This can provide a more accurate picture of your financial future, helping you make more informed decisions about your retirement.

Finally, retirement cash flow software can be customized to your individual financial situation. This means that the software can take into account your specific income, expenses, investments, and other financial factors. This can provide a more accurate and personalized projection of your retirement cash flow.

There are several popular retirement cash flow software options available in the market. These include Personal Capital, Mint, and Quicken. Each of these software options offers a range of features and tools to help you plan for your retirement.

Personal Capital offers a comprehensive retirement planning tool that includes income projection, expense projection, investment analysis, and retirement scenario planning. Mint offers a simpler, more user-friendly interface, but lacks some of the advanced features of Personal Capital. Quicken offers a range of financial management tools, including budgeting, investment tracking, and tax planning.

When comparing these software options, it is important to consider their features, ease of use, and pricing. Personal Capital offers a more comprehensive set of features, but may be more difficult to use for beginners. Mint is more user-friendly, but lacks some of the advanced features of Personal Capital. Quicken offers a good balance of features and ease of use, but may be more expensive than the other options.

V. Case Studies of Successful Retirement Planning Using Cash Flow Software

There are many real-life examples of individuals who have successfully used retirement cash flow software to plan for their retirement. These individuals have used the software to gain a clear understanding of their financial situation, make informed decisions about their retirement, and achieve their retirement goals.

For example, one individual used retirement cash flow software to understand how changes in their investment strategy could impact their retirement income. By using the software, they were able to make strategic changes to their investment strategy and significantly increase their retirement income.

Another individual used retirement cash flow software to plan for their early retirement. By using the software, they were able to understand how much they needed to save and invest to achieve their early retirement goal. This allowed them to make strategic decisions about their savings and investments, and achieve their goal of early retirement.

VI. Conclusion: The Future of Retirement Planning with Cash Flow Software

The future of retirement planning is likely to be heavily influenced by advancements in software technology. As technology continues to evolve, retirement cash flow software is likely to become more sophisticated and powerful. This will allow individuals to gain a deeper understanding of their financial situation, make more informed decisions about their retirement, and achieve their retirement goals.

Integrating technology into retirement planning is becoming increasingly important. As the complexity of financial management increases, the need for sophisticated financial tools is becoming more apparent. Retirement cash flow software provides a powerful solution to this challenge, allowing individuals to manage their retirement finances with ease and accuracy.

Whether you are planning for early retirement, exploring different investment options, or simply trying to understand your financial future, retirement cash flow software can be a valuable tool. By providing a clear picture of your financial future, it can help you make informed decisions and achieve your retirement goals.